Expert & reliable business tax preparation and filing

FiFlow, taxes made simple

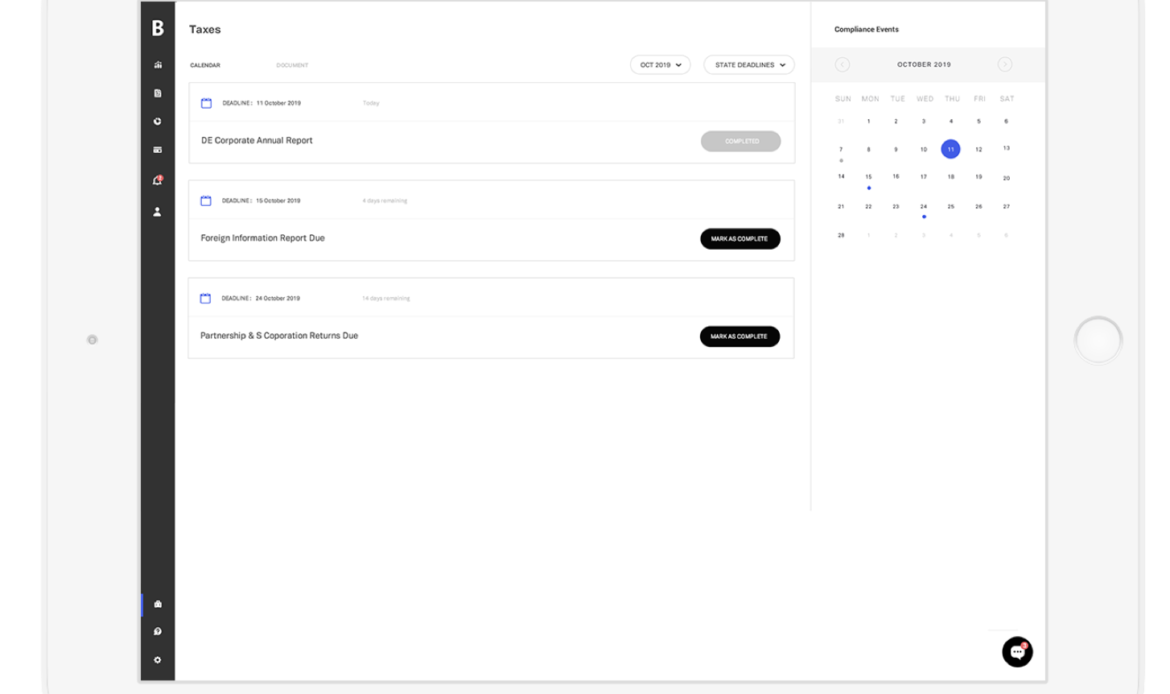

The FiFlow team can handle your corporate and business taxes stress-free. At FiFlow, we take the stress and pain out of filing your taxes. No more confusion as to what you need to do or when, thanks to our tax compliance calendar.

We simplify the process to make sure that you fully understand how your business is taxed and when it is taxed ahead of time; we don’t believe in surprises when it comes to taxes.

Why small businesses love stress-free tax filing with FiFlow

Tax season ready books

Think about the possibility of being tax season ready, every day of the year with up to date books.

Stress free tax season

Enjoy a stress free tax season with none of the hassle or scrambling. Our tax team will tell you which deadlines at the federal, state & local levels are important for your business.

Get the most out of your tax returns

FiFlow will help you take advantage of every business expense and deduction possible for your type of entity.

Quarterly federal business tax estimates

Your FiFlow tax team allows you to see your tax liability in real-time. No more surprises when it comes to tax time. Check your tax liability on a quarterly basis. Knowing ahead of time makes sure that you are mindful of any cash flow implications.

Depreciation analysis after acquiring new assets

We understand that you need new equipment or vehicles for your business. Is it sensible to buy that truck now or should I lease it? This is a question that can be answered by FiFlow Tax. We calculate your tax implications for each asset quarterly to provide you with definitive answers to your asset acquisition inquiries. Our tax specialists are always available to speak to you when you are mulling over a new equipment purchase.

FiFlow is always here as a sounding board to provide guidance in all equipment purchases your business is considering.

What Our Clients Say

FiFlow takes the back office workflows off our shoulders, making what was once a complicated process easier and much less time-consuming

Founder, AppleBiotic

The vast majority of CPAs are simply not putting enough time and attention toward e-commerce bookkeeping. FiFlow has transformed how I run my business. Not only do they match my revenue exactly as described, but their resourceful referrals helped me save 5% of my expense.

Co-Founder, Succulentsbox.com